Extract coefficients from an adaptive PENSE (or LS-EN) regularization path fitted by pense()

or elnet().

Usage

# S3 method for class 'pense_fit'

coef(object, lambda, alpha = NULL, sparse = NULL, standardized = FALSE, ...)Arguments

- object

PENSE regularization path to extract coefficients from.

- lambda

a single number for the penalty level.

- alpha

Either a single number or

NULL(default). If given, only fits with the givenalphavalue are considered. Ifobjectwas fit with multiplealphavalues, and no value is provided, the first value inobject$alphais used with a warning.- sparse

should coefficients be returned as sparse or dense vectors? Defaults to the sparsity setting in

object. Can also be set tosparse = 'matrix', in which case a sparse matrix is returned instead of a sparse vector.- standardized

return the standardized coefficients.

- ...

currently not used.

Value

either a numeric vector or a sparse vector of type

dsparseVector

of size \(p + 1\), depending on the sparse argument.

Note: prior to version 2.0.0 sparse coefficients were returned as sparse matrix

of type dgCMatrix.

To get a sparse matrix as in previous versions, use sparse = 'matrix'.

See also

coef.pense_cvfit() for extracting coefficients from a PENSE fit with

hyper-parameters chosen by cross-validation

Other functions for extracting components:

coef.pense_cvfit(),

predict.pense_cvfit(),

predict.pense_fit(),

residuals.pense_cvfit(),

residuals.pense_fit()

Examples

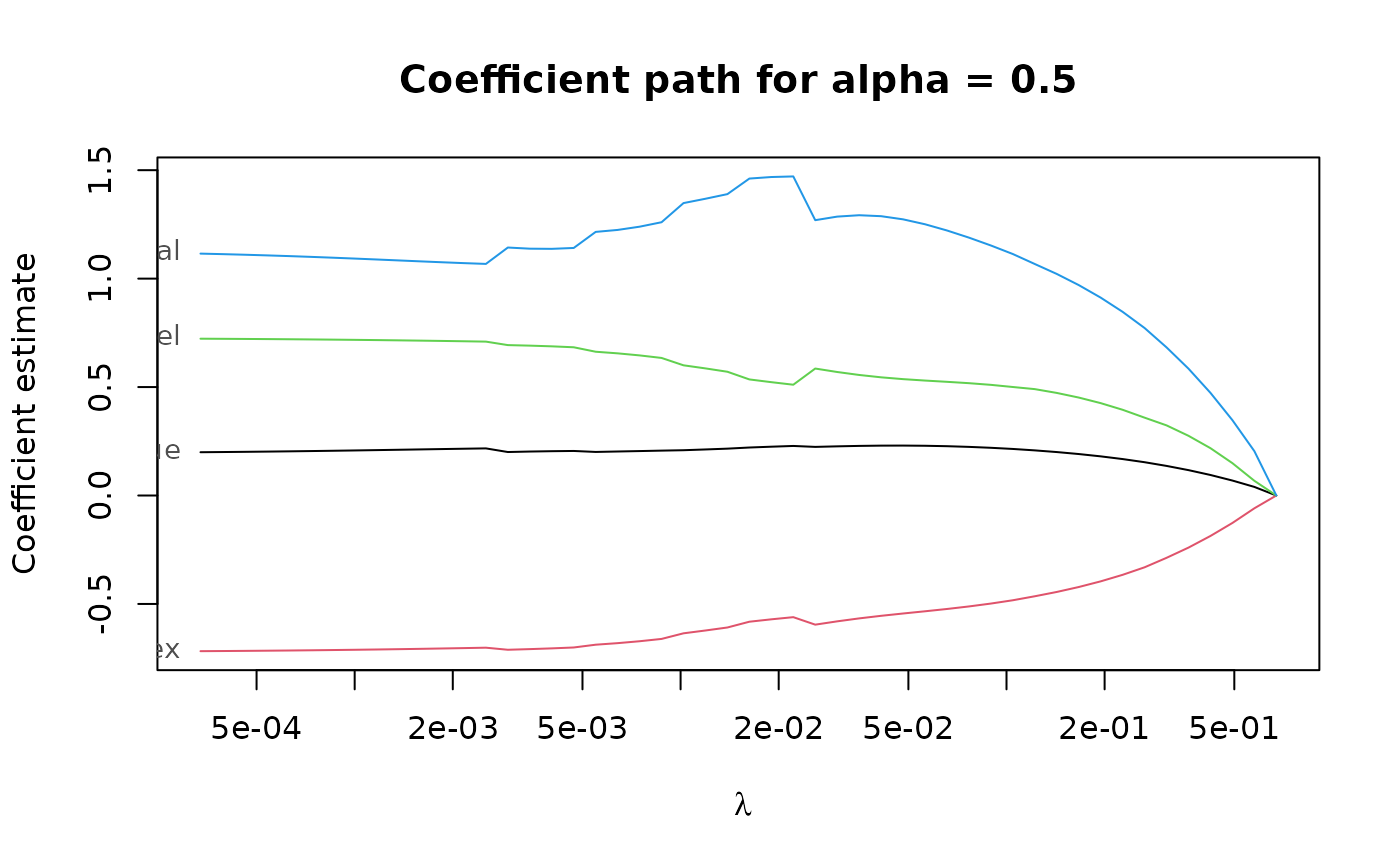

# Compute the PENSE regularization path for Freeny's revenue data

# (see ?freeny)

data(freeny)

x <- as.matrix(freeny[ , 2:5])

regpath <- pense(x, freeny$y, alpha = 0.5)

plot(regpath)

# Extract the coefficients at a certain penalization level

coef(regpath, lambda = regpath$lambda[[1]][[40]])

#> (Intercept) lag.quarterly.revenue price.index

#> -6.5082299 0.2510560 -0.6879670

#> income.level market.potential

#> 0.7090986 0.9409940

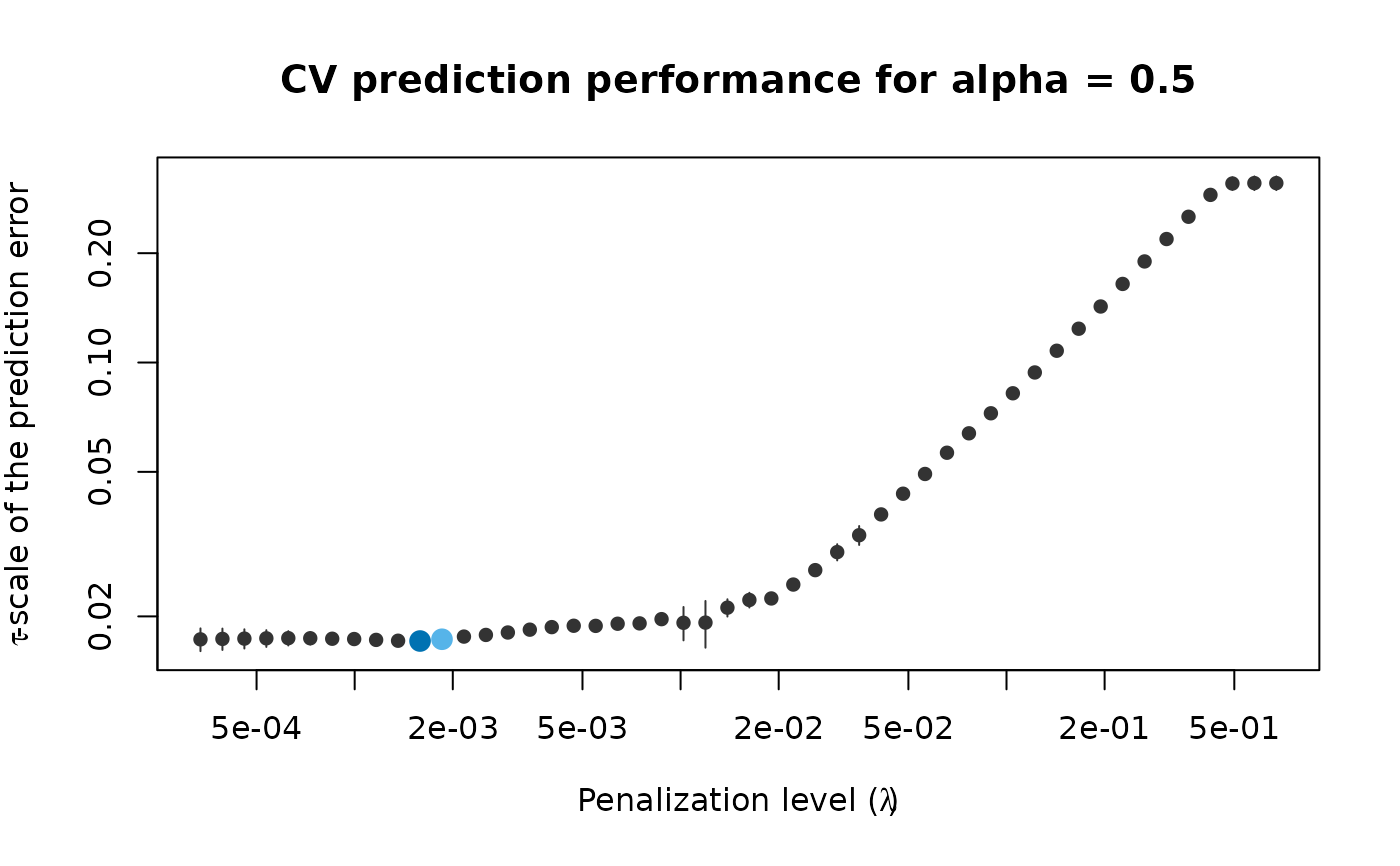

# What penalization level leads to good prediction performance?

set.seed(123)

cv_results <- pense_cv(x, freeny$y, alpha = 0.5,

cv_repl = 2, cv_k = 4)

plot(cv_results, se_mult = 1)

# Extract the coefficients at a certain penalization level

coef(regpath, lambda = regpath$lambda[[1]][[40]])

#> (Intercept) lag.quarterly.revenue price.index

#> -6.5082299 0.2510560 -0.6879670

#> income.level market.potential

#> 0.7090986 0.9409940

# What penalization level leads to good prediction performance?

set.seed(123)

cv_results <- pense_cv(x, freeny$y, alpha = 0.5,

cv_repl = 2, cv_k = 4)

plot(cv_results, se_mult = 1)

# Print a summary of the fit and the cross-validation results.

summary(cv_results)

#> PENSE fit with prediction performance estimated by 2 replications of 4-fold ris

#> cross-validation.

#>

#> 4 out of 4 predictors have non-zero coefficients:

#>

#> Estimate

#> (Intercept) -4.7921541

#> X1 0.3338834

#> X2 -0.6140406

#> X3 0.6954769

#> X4 0.7316339

#> ---

#>

#> Hyper-parameters: lambda=0.0003364066, alpha=0.5

# Extract the coefficients at the penalization level with

# smallest prediction error ...

coef(cv_results)

#> (Intercept) lag.quarterly.revenue price.index

#> -4.7921541 0.3338834 -0.6140406

#> income.level market.potential

#> 0.6954769 0.7316339

# ... or at the penalization level with prediction error

# statistically indistinguishable from the minimum.

coef(cv_results, lambda = '1-se')

#> (Intercept) lag.quarterly.revenue price.index

#> -11.4754472 0.2265866 -0.5739724

#> income.level market.potential

#> 0.5417608 1.3768215

# Print a summary of the fit and the cross-validation results.

summary(cv_results)

#> PENSE fit with prediction performance estimated by 2 replications of 4-fold ris

#> cross-validation.

#>

#> 4 out of 4 predictors have non-zero coefficients:

#>

#> Estimate

#> (Intercept) -4.7921541

#> X1 0.3338834

#> X2 -0.6140406

#> X3 0.6954769

#> X4 0.7316339

#> ---

#>

#> Hyper-parameters: lambda=0.0003364066, alpha=0.5

# Extract the coefficients at the penalization level with

# smallest prediction error ...

coef(cv_results)

#> (Intercept) lag.quarterly.revenue price.index

#> -4.7921541 0.3338834 -0.6140406

#> income.level market.potential

#> 0.6954769 0.7316339

# ... or at the penalization level with prediction error

# statistically indistinguishable from the minimum.

coef(cv_results, lambda = '1-se')

#> (Intercept) lag.quarterly.revenue price.index

#> -11.4754472 0.2265866 -0.5739724

#> income.level market.potential

#> 0.5417608 1.3768215